CONSUMER’S SURPLUS

The concept of consumer’s surplus was first introduced by Alfred Marshall. the difference between the amount of money that a consumer actually pays for buying a certain quantity of commodity and the amount he would be willing to pay for the same quantity rather than go without it. When a consumer is prepared to buy a commodity, he always calculates the utility he is going to derive from its consumption. Every rational consumer compares the utility he derives from the consumption of a commodity, against the price he has to pay. If the utility is more than the price paid, he prefers it and if it is vice-versa, he does not buy the same good. The surplus of utility he derives is the consumer’s surplus. In a nutshell, a consumer’s surplus is the difference between what the consumer is willing to pay and what he actually pays.

Assumptions of the Consumer’s Surplus

- The marginal utility of money for the consumer is assumed to be the same throughout the process of exchange.

- The commodity does not have substitutes.

- In the market at the given point of time, there are no differences in income, tastes, preferences, and fashions among the consumers

- Each commodity is considered independent of others

Explanation

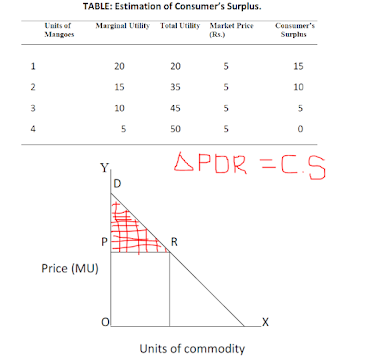

In explaining the consumer’s surplus, the law of diminishing marginal utility is recapitulated here. The particulars presented in the table reveal that when a person prefers to purchase mangoes at a price of Rs. 5 each, the marginal utility derived is equivalent to Rs. 20 from the first mango, at which marginal utility and price are equal. The consumer will not go beyond the 4th mango because at this level the price of mango is equal to the marginal utility obtained by the consumer. From the consumption of the first three mangoes, the consumer enjoys a surplus utility of Rs. 30. This is the total consumer’s surplus. There is no consumer’s surplus for the fourth unit. The diagrammatic representation of consumer’s surplus is shown.

Along X-axis units of a commodity are measured and along Y-axis marginal utility in terms of money is measured, DD is the demand curve. At OP Price the number of mangoes purchased is OQ. At price OP, the total amount paid for OQ units of a commodity (mango) is OP*OQ and in the graph, the area is represented as OQRP. But the actual amount the consumer is willing to pay for OQ units is OQRD. The consumer’s surplus, therefore, is OQRD – OQRP i.e., DRP. An increase in price causes a reduction in consumer’s surplus, while a fall in price leads to an increase in consumer’s surplus.

Importance of Consumer’s Surplus

1. Conjunctural Importance: When people enjoy a larger consumer’s surplus, it does not indicate that they are better off. Thus it serves as an index of economic betterment.

2. Useful to the Monopolist: The monopolist can freely raise the prices of the goods if they bring in a higher consumer’s surplus, without any fear of foregoing the sales.

3. Helps in Public Finance and Taxation: More taxes can be imposed by the Government to get more revenue, on those goods for which consumer’s surplus is high.

4. Helps to Measure Benefits from International Trade: in international trade, those commodities which are cheaper in foreign markets are imported. Before their imports, the consumers were paying a higher price. With the availability of imported goods that are cheaper, the consumers get a surplus of satisfaction. Greater surplus indicates, larger benefits from international trade.

Producer surplus

Producer surplus is a measure of producer welfare. It is measured as the difference between what producers are willing and able to supply a good for and the price they actually receive.

Comments

Post a Comment